Do you know that registering a business is essential, particularly for creating a distinctive identity for the business?

On June 15, 2020, the Royal Government of Cambodia has officially launched the Online Business Registration Platform Phase 1 known as the Single Portal, which allows users to submit only one application for business registration at the Ministry of Commerce (MoC), tax registration at the General Department of Taxation (GDT) of the Ministry of Economy and Finance (MEF), the declaration of enterprise-establishment opening at the Ministry of Labour and Vocational Training (MLVT) and the recently-added registration of enterprises/establishments at the National Social Security Fund (NSSF).

Before the official launch of the Single Portal, some business owners have not completed their business registration process as the business is only registered at the Ministry of Commerce but have not been registered at the General Department of Taxation or vice versa. Now, new functions have been added to the Single Portal to allow for the completion of the registration for both types of companies/enterprises that registered at the Ministry of Commerce or the General Department of Taxation before June 15, 2020.

For Tax-Registered Company/Enterprise but Not Business-Registered

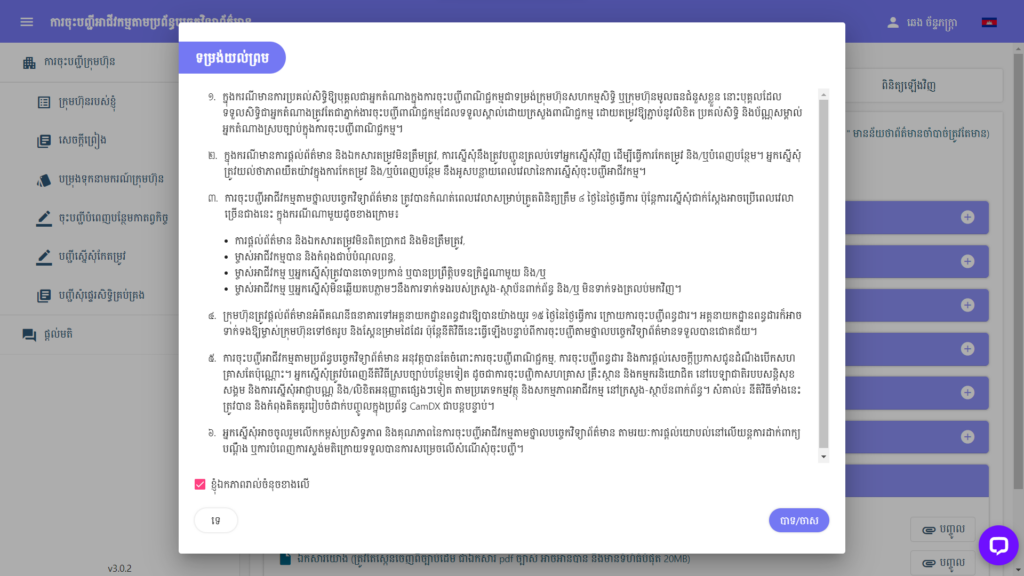

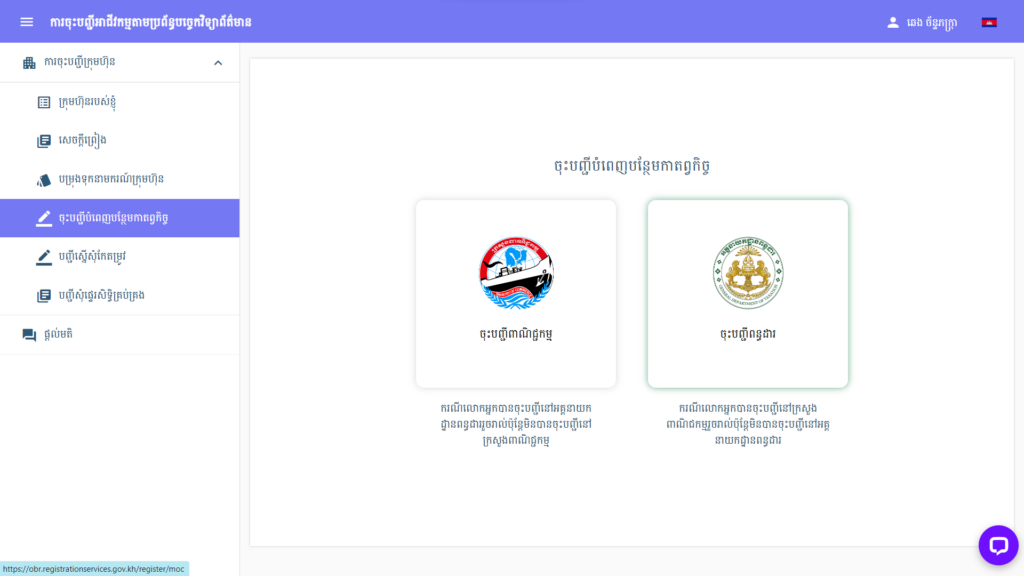

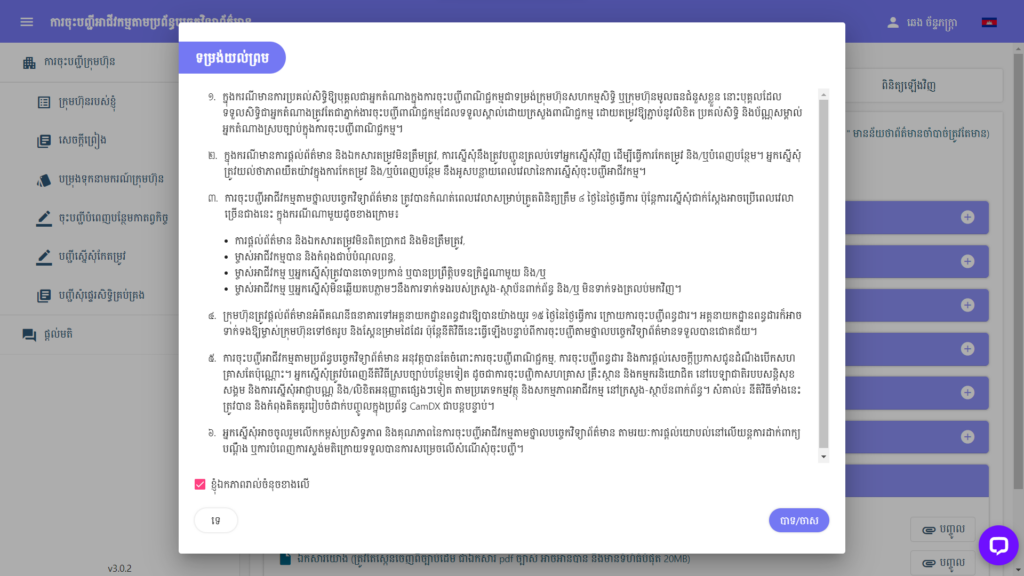

To complete the business registration procedure, firstly user needs to log into the Single Portal at www.registrationservices.gov.kh and click on the “Business Registration” button at the top of the website. The user shall log into the system using the CamDigikey mobile application by scanning the QR code appeared on the system (Click Here for how to create a CamDigiKey account). After that, the user shall click on the “Complete Registration” button and then the “Business Registration” button. The user shall carefully read the “Consent Form”, then tick the box in front of the “I hereby agree to the above-mentioned points” and click “Yes”.

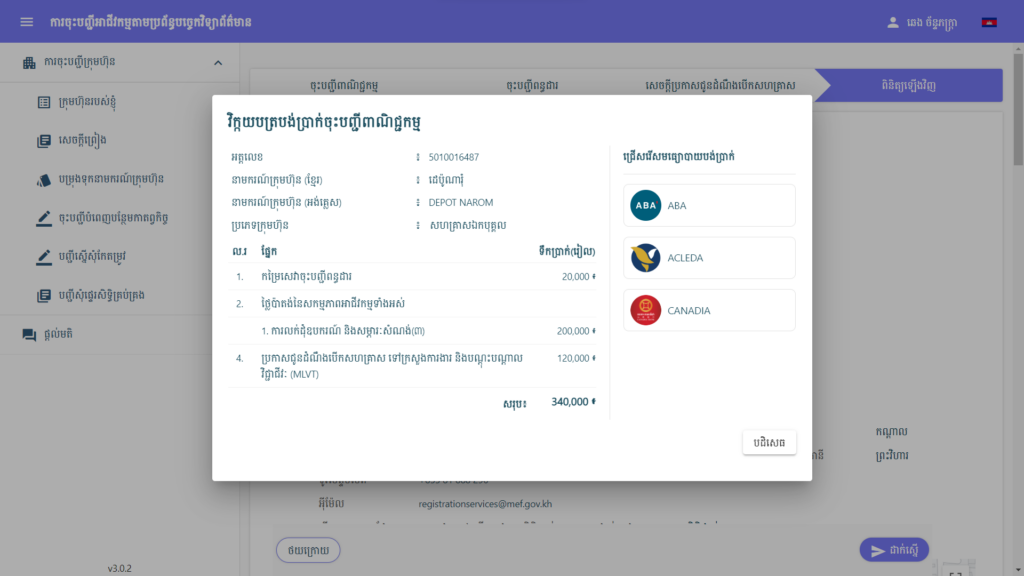

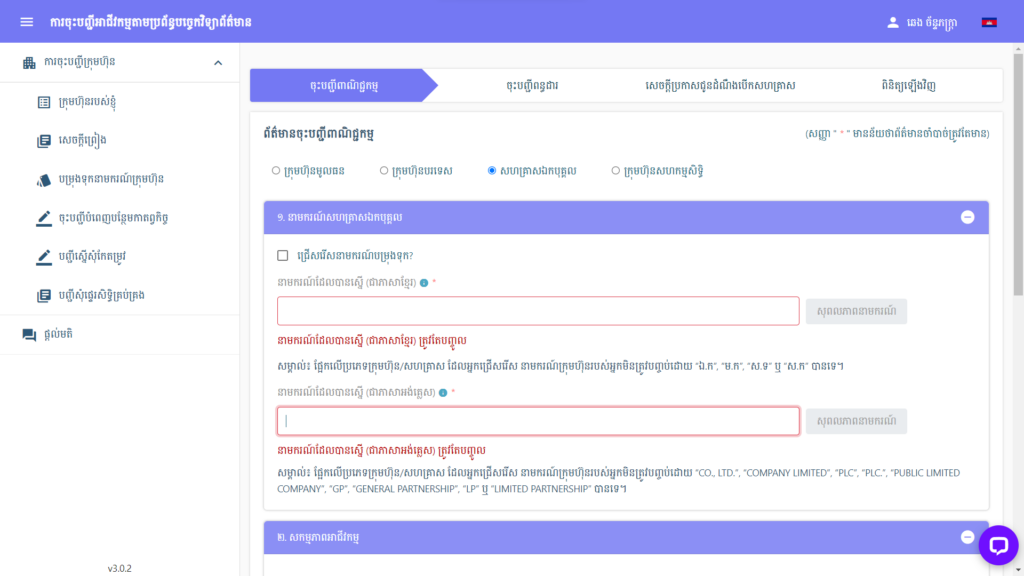

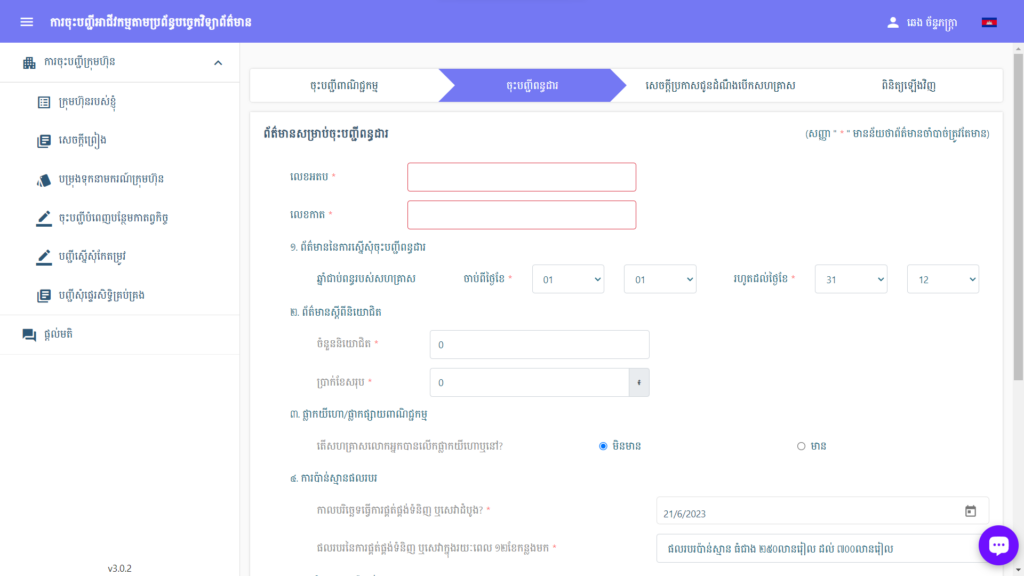

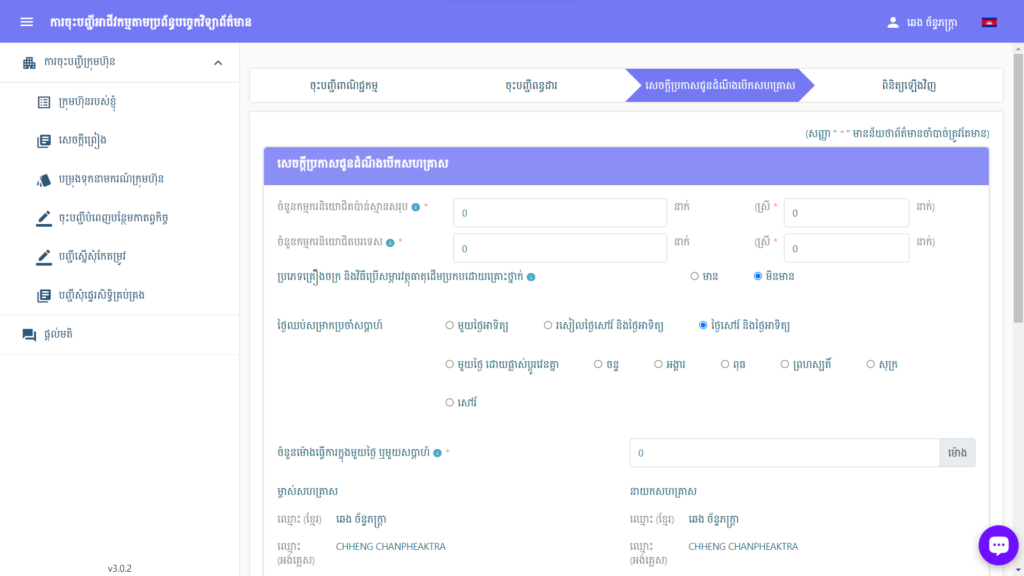

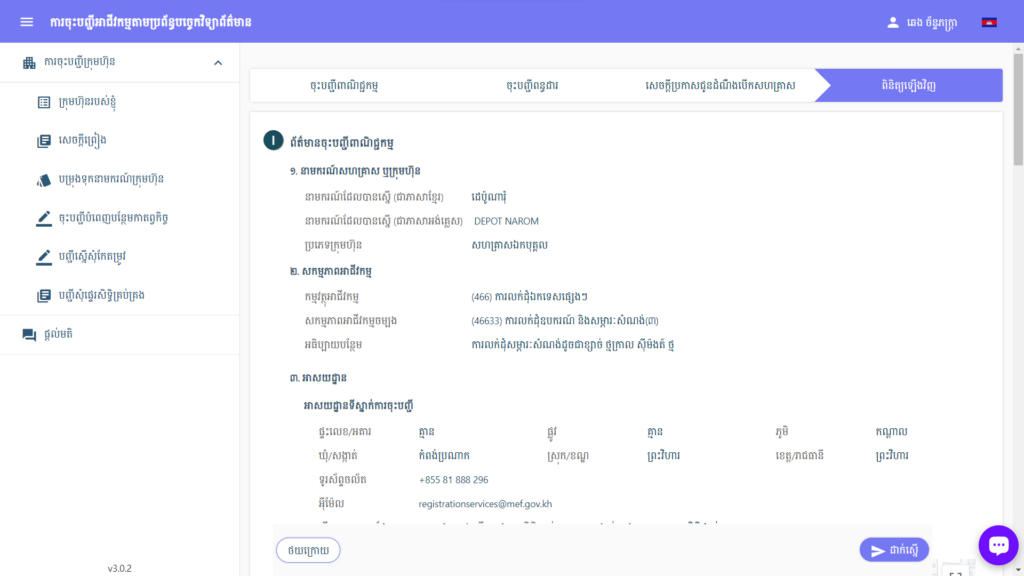

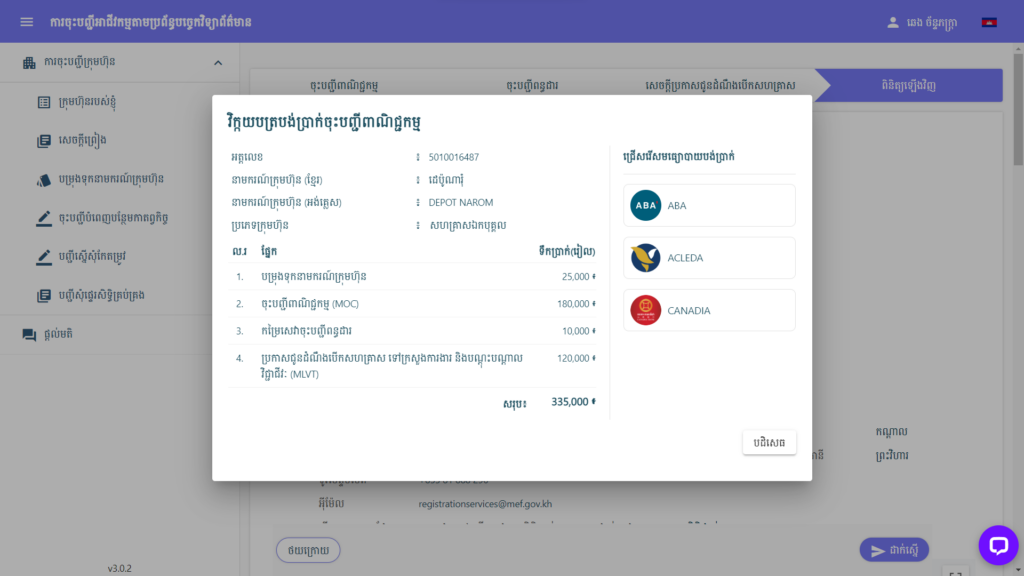

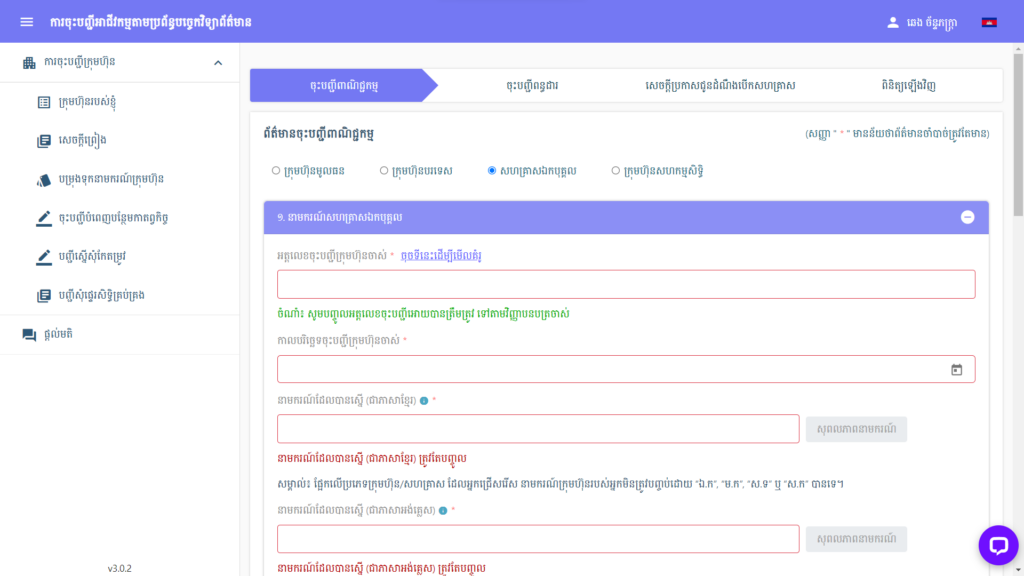

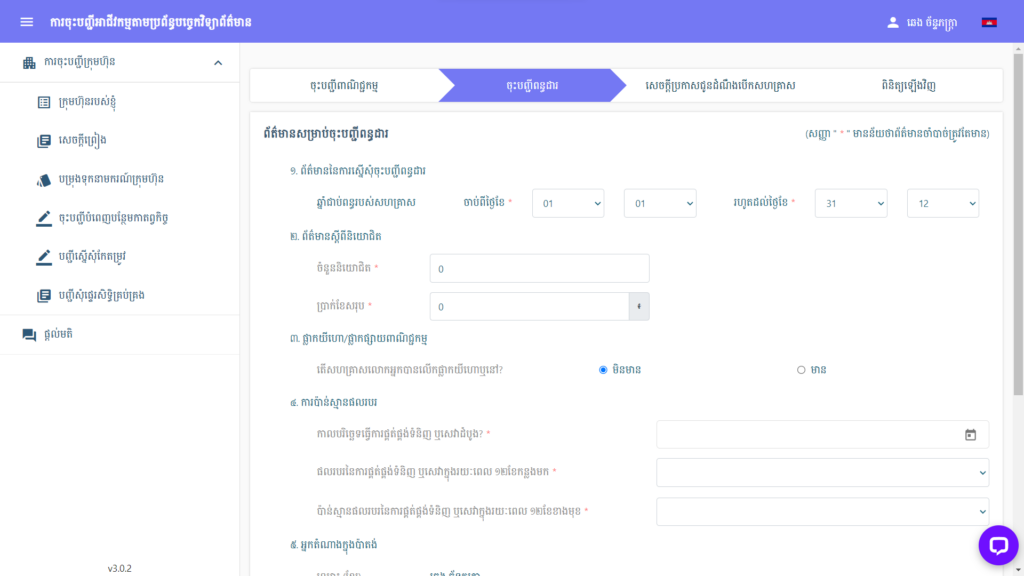

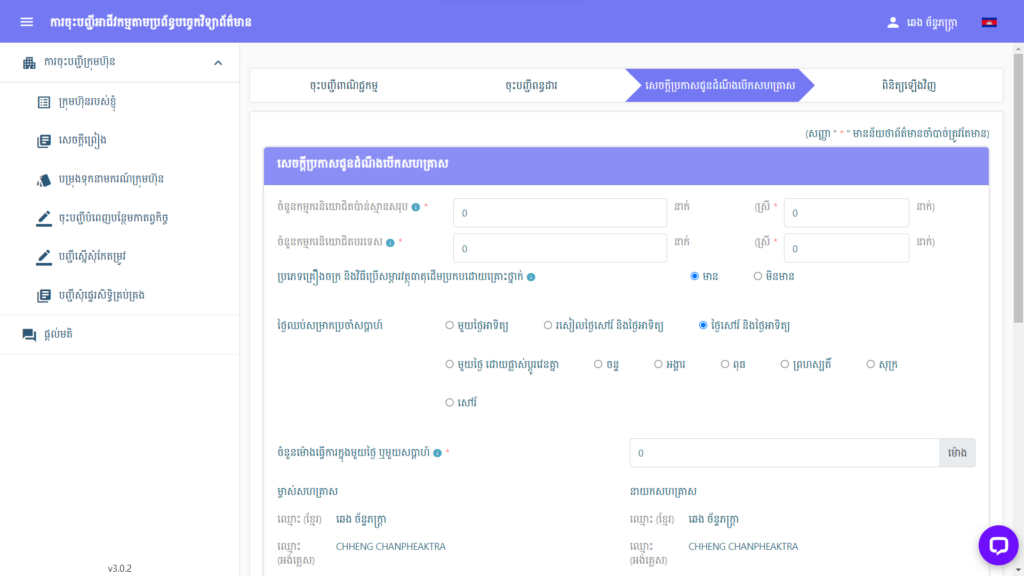

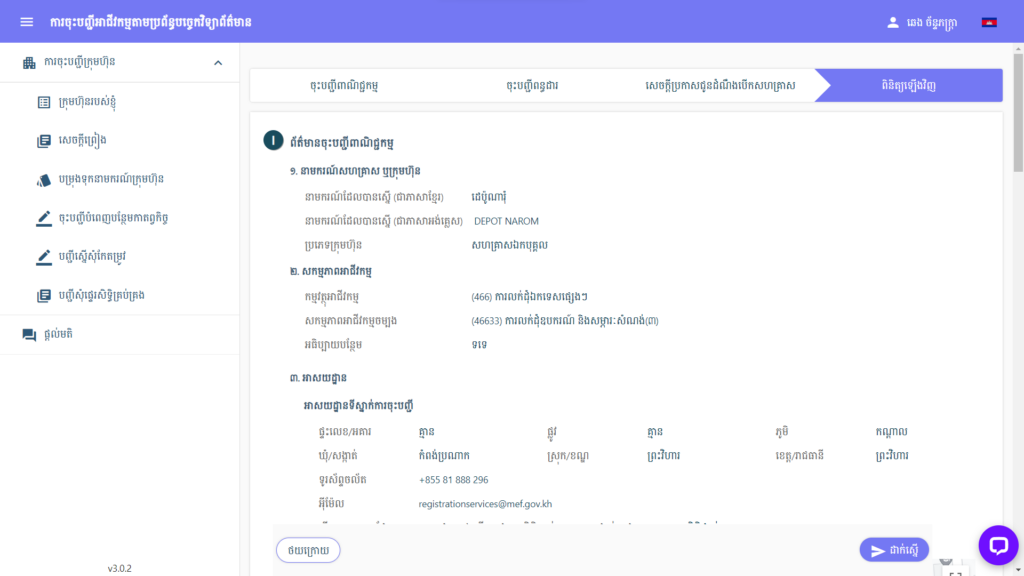

This application form is divided into four main sections, including (1) the business registration section, (2) the tax registration section, (3) the declaration of enterprise-establishment opening section, and (4) the review section. The user is responsible for accurately filling out each section of the form and making sure that it adheres to the previously completed tax registration. Inconsistency of information or untruthful information may lead to the “return” of the application from the relevant ministries/institutions. In the last part of the application form, the user needs to review the information and attached files again and click “Submit”. The last step is for the user to select a payment method and pay according to the instructions to complete the transaction.

All supporting documents shall be scanned from original document, in pdf format, readable and have a maximum file size of 20MB and, during this process, the tax registration is not charged.

If your company/enterprise falls under one of the aforementioned categories, please comply with the brief steps shown below:

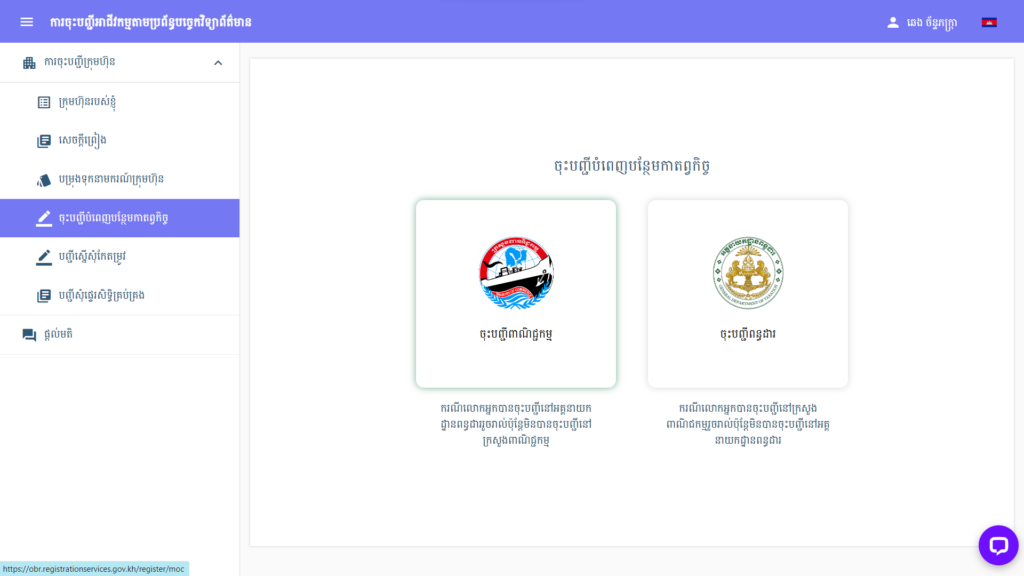

1.Click the “Complete Registration” button and then the “Business Registration”

2. Read the “Consent Form” carefully, then tick the box in front of the “I hereby agree to the above-mentioned points” and click “Yes”.

3. Choose the enterprise form that best fits your company/enterprise and fill out the information and attach supporting documents in the “Business Registration” section and click “Next“.

4. Fill in the tax registration information according to the previously completed tax registration and attach tax-related documents in the “Tax Registration” section and click “Next”.

5. Fill in information and attach documents for the “Declaration of Enterprise-Establishment Opening” and click “Next“.

6. Review the information and documents and click the “Submit” button.

7. Select a payment method and pay according to the instructions.

For Business-Registered Company/Enterprise but Not Tax-Registered

In the case that company/enterprise has registered the business at the Ministry of Commerce but has not been registered at the General Department of Taxation, tax registration is also possible on the Single Portal. The user needs to simply log into the Single Portal using the CamDigiKey mobile application. After logging in, click the “Complete Registration” button and then the “Tax Registration” button. The user shall carefully read the “Consent Form”, then tick the box in front of the “I hereby agree to the above-mentioned points” and click “Yes”. Similar to the first case where company/enterprise is tax-registered but not business-registered, the application form comprises of the same four sections in which information to be filled shall be consistent with the previous registration at the Ministry of Commerce. All supporting documents shall be scanned from original document, in pdf format, readable and have a maximum file size of 20MB. After submission, the payment is also made online, and the registration at the Ministry of Commerce is not charged.

If your company/enterprise falls under one of the aforementioned categories, please comply with the brief steps shown below:

1. Click on the “Complete Registration” button and then the “Tax Registration” button.

2. Read the “Consent Form” carefully, then tick the box in front of the “I hereby agree to the above-mentioned points” and click “Yes”.

3. Fill in the completed business registration information consistently in the form and click “Next“.

4. Fill in information and attach documents for tax registration and click “Next”.

5. Fill in information and attach documents for declaring enterprise-establishment opening and click “Next”.

6. Review the information and documents and click “Next”.

7. Select a payment method and pay according to the instructions.